When planning our investments, we’ve all heard the old expression “good things come to those who wait”.

In the financial world this is a half-truth.

If you want to accumulate enough wealth to achieve financial and investment goals such as retirement, then good things don’t simply come to those who wait; they come to those who initiate – as soon as possible – a savings and investment strategy utilizing one of the most powerful tools available for investors: compounding.

As Benjamin Franklin famously described it, compounding is the process whereby “Money makes money. And the money that money makes, makes money.” Growth creates more growth, and so on. This process, when multiplied exponentially for very long periods of time, is what gives men like Warren Buffet their immense wealth and puts any short-term get-rich-quick scheme to shame.

The best news is, unlike Buffet, we don’t need to start with millions to benefit from this simple and effective strategy.

How to get started? Let’s dive into the world of compounding.

What is compounding?

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

– Albert Einstein

Compounding is the practice of reinvesting the income made on an investment back into, or on top of, the original principal amount first invested. In other words, the income made from an investment is then re-inserted again, over and over, to grow the total amount of cash that’s earning income.

Like a money-snowball rolling down a hill, growth becomes exponential over time as the income multiplies. As increasing growth is layered on top of increasing growth – as it’s “compounded” – the original investment sum becomes dwarfed by the amount of growth that’s accumulated.

Let’s look at an extreme but fun example. Answer this question to yourself honestly: Would you rather have $1 million handed to you today, or would you rather have one cent – $0.01 – doubled every day, for 30 days? Now, take out your phone or your calculator and give it a try: multiply 0.01 x 2, and press ‘=’ 29 times.

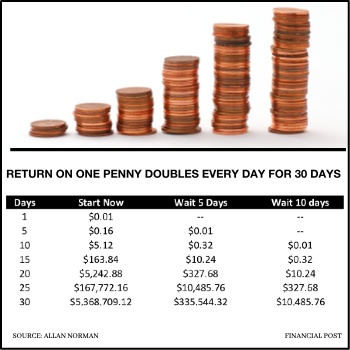

Surprised? If you took the cool million doled out to you today, then you would soon lose out on more than $4 million dollars that would compound over the next 30 days, thanks to the exponential growth of that initial penny to a staggering $5,368,709.12.

Here’s a handy chart from The Financial Post, which also illustrates the cost of delaying the start of savings by two, five, and ten days:

For those of us not able to magically double our investment pennies every day, consider this more modest example set at a growth rate of 7.2% (a historically reasonable rate when considered over the long-term). If Marc invests $1,000 at the age of 20 and doesn’t touch it until retiring at the age of 70, he would grow it to $32,000. 32 x your initial investment. Impressive. The power of compounding at work.

Consider this next example. If Marc invests $1,000 at the age of 20 and continued to add $83 a month until he was 70, then he would have $465,000 waiting for him in the bank when he’s ready to retire. Very impressive. The power of compounding amplified by consistent savings leads to extraordinary results.

How can I compound my investments?

What’s holding us back isn’t our financial literacy, intelligence, or expertise. It’s our own individual psychology and behavior that favours immediate, short-term rewards over the probability of long-term gains.

Compounding requires our minds to wrap around two basic attributes if it’s to work: patience and consistency.

For human beings, these traits are easy to talk about, but difficult to execute.

First, patience: Investors must start saving as early as possible, contribute to a diversified investment portfolio for as long as possible, and then, as the Tom Petty song goes: the waiting is the hardest part. And, you guessed it – you must wait for as long as possible.

Forget the roller-coaster imagery of a fast-paced stock market. Your investments should be boring, and you should pick up another hobby if you’re looking for excitement.

The reward? This is where consistency comes in. Thanks to your long time horizon, by investing consistently over many years through both bear and bull markets, the purchasing power of your re-investments are – on average – maximized. Emotional decisions and the FOMO (fear-of-missing-out) on the latest trends are replaced by consistency, discipline, and the market’s tendency to move upwards over time.

Crucial to this, however, is the rate of savings at the beginning of the compounding process. As noted above, putting away $10,000 per year will have drastically different returns for a 20-year-old than a 40-year-old, due to the 20 lost years of compounding time that the savvy young investor gains. Every 10 years of delay will require three times the amount of savings per month to catch up.

Starting as early as possible, as consistently as possible, without ever dipping into your compounding portfolio to withdraw funds – no interruptions! – is therefore essential to multiplying investment principles into enormous long-term growth.

Why Do I Not Believe This? Or, Why Does it Blow My Mind?

Human beings are designed to think in linear terms, or from A to B. It’s easy to add 2+2+2+2+2+2+2+2+2 into a sum of 18.

Unfortunately, we mortals are horrible at thinking exponentially, which is exactly how compounding works. Just try multiplying 2x2x2x2x2x2x2x2x2. Took a little longer to reach 512 in this case, right?

Human psychology finds it so difficult to grasp exponential growth that we tend to give up on or abandon things we feel aren’t giving us immediate and obvious returns on our investments. Whether it’s exercising, investing, or learning new skills, we’re too fast to quit when the real results gained in these areas take time to grow and then multiply – and indeed, the results can be incredible, if only we are diligent and patient enough to get there over time.

This is far easier said than done. It is easy to lose sight of the power of compounding, especially when the markets are careening and your portfolio value is declining day after day. As we explored in our first blog, understanding how much risk we can tolerate, and then investing in a manner consistent with this tolerance and focusing on the long-game and not the daily headlines, is the key to a positive investment experience.

This takes us to another crucial component of compounding successfully: not removing any money or funds from the growth your portfolio experiences over time. It is actually in the last stages of growth, that the rewards are the greatest.

For instance, returning to Warren Buffet: it took him 75 years of investing to achieve wealth of $81 billion, and most of this came after his 50th birthday, and after he qualified for social-security benefits in his 60s. If he had removed any wealth to spend, or if he had started investing in his 30s, we never would have heard of him.

Want to Compound Effectively? Change your Mindset

As human beings, we fail to understand how financial risk, time, and market swings intersect to shape how we feel on a given day about our investment portfolios.

We might hear talks of inflation and global recession, and we feel anxious and see only recent losses in our portfolios; we might see our friends and neighbours succeeding financially, and we invest in riskier “get rich quick” stocks or schemes out of envy and a desire for quick gains; or, since the days are long and the years feel short, we might discount longer-term investment strategies because thinking decades ahead, just isn’t in the cards when we’re focusing on work, jobs, kids, and bills, today.

If we focus on the short-term, we miss the forest for the trees. Short-term thinking emphasizes immediate gains and losses, while the long-term thinking necessary for compounding averages out gains and losses over decades of market growth. As long as your portfolio is well diversified (i.e., you haven’t put all of your eggs into one stock or asset), you’ll see your own wealth start snowballing as growth is layered upon growth.

Who Should Do It?

It’s not a secret that the younger you start compounding the more money you’ll accumulate as the decades go by. As noted above, Warren Buffet started at the tender age of 12. Even a twenty-something living in their car can become a millionaire in their retirement if they invest consistently in a diversified, compounding portfolio.

However, if you are a 40-year-old or 55-year-old investor just starting out, does this mean you should abandon all hope, as you’ve missed the boat? Not at all. Although your results may not be as mind-blowing as the 25-year-old compounding for 40+ years, starting late is far better than never starting at all.

In fact, the older you are, the higher the odds are that you will be farther along in your career path and can invest larger sums than you could have 20 or 30 years ago.

Similarly, as your compounding portfolio grows, the temptation to dip into it can entice even the savviest young investor to pay for a down-payment on their mortgage, on cars, on kids, etc. As an older investor, odds are that you’re past these temptations and you have a trouble-free window of time to compound as much as possible before retirement.

For you Canucks reading this, it’s also important to remember that being north of the 49th parallel might change some strategies for compounding.

First, Canadian investors with a global portfolio must always consider the impact of foreign exchange on their portfolio’s growth if the Canadian dollar rises in relation to a foreign investment, and the currency conversion squashes any profits accrued.

Secondly, remember that the taxman cometh: different types of investment income attract different levels of tax. For example, dividends from Canadian equities are tax advantaged when compared to interest income earned on a GIC, so being mindful of tax efficiencies and the tax characteristics of the accounts where your investments reside (e.g., a TFSA vs. an RRSP vs. a taxable investment account) – may boost your compounding efforts.

As the old saying goes, the best time to plant an oak tree was 20 years ago. The second best time is today. So get compounding.

Conclusion

We understand what it’s like to think about investing during periods of geo-political and financial uncertainty. It’s unnerving to imagine one’s hard-earned pay-cheque disappearing into a market crash or a company that goes belly-up.

Remember: there are ways to make safe investments in dangerous times. Intelligent investing done consistently and over a long period of time overcomes both the pendulum-swings of the market and our own psychological fears, anxieties, and irrational behaviors. Since no one knows exactly when markets will rise or fall, the key to investing is to trust in the long-term realities of market dynamics: history shows that gains are highly probable but difficult to grasp immediately, in the everyday short-term flux of living life.

We would all like to get rich quickly. The reality is, it’s a long time in the market that gets us to where we need to be to retire or to create generational wealth for our family members to come.

You’d better get started. Good things come to those who initiate. And then you can sit back and wait, while good things happen as your money makes more money in the process.

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and Investment Industry Regulatory Organization of Canada (“IIROC”). Investment services are provided through ACPI. Only investment-related products and services are offered through ACPI and covered by the CIPF. Financial planning, insurance and estate planning-related advice, products and services are provided through Creative Planning Financial Group.

CPFG is an independent company separate and distinct from ACPI.”