If you are an incorporated professional or business owner, you’ve got at least one good problem on your hands right now: having too many options for growing your retirement savings by investing retained earnings in your corporation and / or saving personally via an RRSP and a TFSA. All of these options have their virtues.

RRSPs are the go-to option for Canadians. 51 per cent of the country contributed to these in 2023, with 23 percent contributing the maximum allowable amount. RRSPs are relatively safe bets and offer income splitting options in later years when they’re converted to a Registered Retirement Income Fund (RRIF).

However, the RRSP is not the only game in town. There is another option, the Individual Pension Plan or IPP. Think about it as a supercharged RRSP.

The tale of the IPP starts out simply. An incorporated professional or business owner creates their own defined benefit pension plan in order to reap more tax savings and shelter more assets than an RRSP can provide. For those over 40 years old, the IPP offers higher annual contribution limits than an RRSP and an opportunity to make significant contributions up front.

Let’s look at an example of IPPs in action.

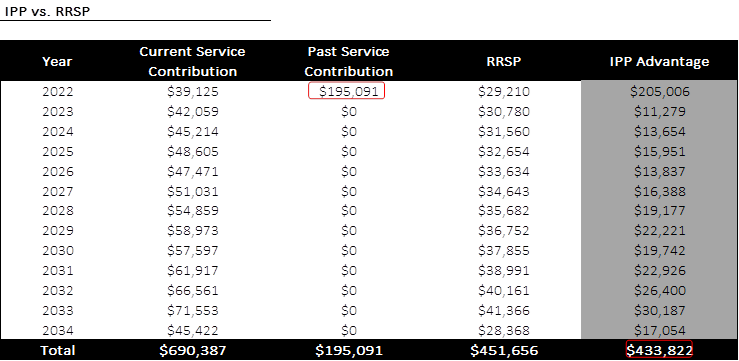

Jimmy and Jonny are twin 52 year-old brothers. They each have successful small businesses. They are both good savers. Jimmy saves every year via his RRSP. In 2022, Jimmy, took advantage of the annual contribution limit, $29,210. Acting on the advice of his wealth advisor, Jonny established an IPP in 2022. Instead of contributing $29,210 to his RRSP, Jonny contributed $39,000 to his IPP. Jonny also took advantage of the “past service pension buyback” available via his IPP and contributed an additional $195,000.

As this chart illustrates, if both brothers retire at age 65, Jonny will have contributed $433k more to his retirement savings than Jimmy!

Other benefits of IPPs include intergenerational wealth transfers and the opportunity to contribute even more into a registered environment if portfolio returns are below a prescribed level.

The IPP story doesn’t end there, and there’s a challenging twist: unsurprisingly, creating your own pension plan isn’t that simple! There’s a level of complexity here that requires consultation with professionals to ensure the IPP is up to code and operational.

That’s where we come in.

Contact us today to discuss how an IPP might help your retirement savings, tax planning, and succession planning.

There’s no ‘one-size-fits-all’ approach to retirement plans, but we’re eager to help you figure out what retirement savings options are the best fit for you and your family’s future.

You down with IPP? Let’s talk and we’ll see.